Federal Funds Appropriated in Texas Generally Are

Low service low tax Texas spending on a per capita basis is much lower than the national average. Coordinate efforts with neighboring states to achieve economies of scale.

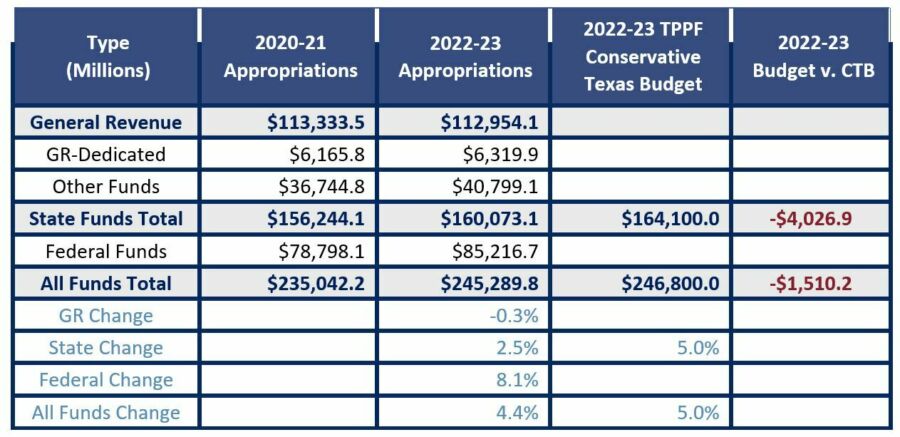

2022 23 Texas Budget Below Tppf S Conservative Texas Budget

Which phrase best characterizes Texas reputation in terms of taxes and services.

/cloudfront-us-east-1.images.arcpublishing.com/gray/N75PNUIJPBBVBJ4NAEBOGKDO7Y.jpg)

. The bulk of federal funds expenditures is in two areas. Generally the State Funds Reform Act requires a state agency to deposit all money it receives in the states treasury. 76 Texas Human Resources Code and 1405e f.

Appropriated funds 7000 through 7999 are reserved for Texas Public Finance Authority TPFA activity as follows. 7000-7199 General Obligation Bond TPFA only Interest and Sinking Rebate Restoration Cost of Issuance 7200-7299 General Obligation Bonds Project 7300-7499. Allow the federal government to manage these programs.

Appropriated Funds Reserved for TPFA Activity. III of Title 45 Code of Federal Regulations and pursuant to ch. Funds are used for financial transactions authorized as follows.

Health and human services and education. Texas ranked 11th highest in federal funds as a share of state government spending 35 percent in 2009. Federal funds appropriated in Texas generally are Concentrated in a few state agencies What is the single largest source of tax revenue for the state of Texas Sales Tax Who pays the greatest portion of their income in property taxes.

After the taxes are collected they are appropriated to federal agencies that allocate funding to states and local governments. This money comes primarily from Federal Income Tax and other federal taxes. The Texas Constitution prohibits a state agency from expending money in the states treasury unless the constitution itself or the.

The general fund is the primary governmental fund type. 1 day agoTexas Gov. A company or a government appropriates funds in order to delegate cash for the necessities of its.

Interest earned on fund balances from the federal Coronavirus Relief Fund CRF appropriated from the US. Federal funds appropriated in Texas generally are. Concentrated in a few state agencies.

Distribution of amounts paid toward child support obligations in accordance with Title IV Part D Federal Social Security Act and ch. In Texas the majority of the federal funds were appropriated to three essential areas of the government which include health and human services public and higher education and economic development - highways and transportation. Appropriated Funds may only be used for the purpose they have been appropriated for.

A 2015 study found that the median monthly dollar amount spent on any lottery game was100. Greg Abbott and top state lawmakers shifted around roughly 1 billion in federal coronavirus aid to help pay for their campaign to arrest migrants at the US-Mexico border exposing. Federal funds appropriated in Texas generally are concentrated on a few state agencies Which phrase best characterizes Texass reputation in terms of taxes and services.

Texas seeks to maintain a favorable environment for. Federal funds are a vital part of any state budget and they are particularly important in the Texas state budget. Treasury to the state of Texas under the Coronavirus Aid Relief and Economic Security CARES Act as well as earned credits and indirect cost recoveries from CRF activity should be deposited to Appropriation 00000 AF 0325 and then as soon as practicable.

The Legislative Budget Boards draft budget NOT the governors budget is the one voted upon by the legislature. Federal money is an important part of the Texas budget but monies that Texas receives from the federal government. Low service low tax.

Appropriated funds 7000 through 7999 are reserved for Texas Public Finance Authority TPFA activity as follows. Poor homeowners and renters. This amount is an 83 percent increase from FFY 2021 funding.

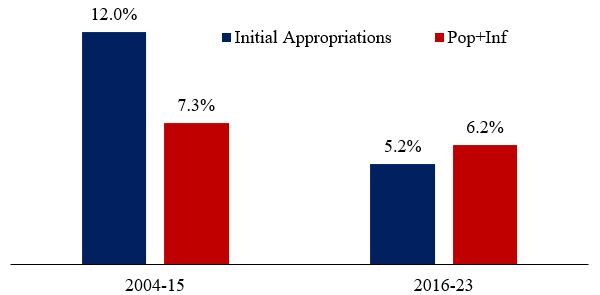

However funds can be allocated in any bill passed by Congress. General Revenue Funds Most federal expenditures in Texas go to education and health and human services. Much lower than the national average.

Federal funds appropriated in Texas generally are concentrated to who. Often come with strings attached. GASB Codification Section 1300104a states that the purpose of a general fund is to account for all financial resources except those required to be accounted for in another fund In most governments the general fund is a very active fund and can become quite complex due to the range of activities such as.

Appropriation is when money is set aside money for a specific and particular purpose or purposes. However in order to receive these funds Texas must a. 7000-7199 General Obligation Bond TPFA only Interest and Sinking Rebate Restoration Cost of Issuance 7200-7299 General Obligation Bonds Project 7300-7499.

The Comptrollers office is the trustee of the money in the states treasury and has important investment responsibilities for that money. Texas uses a significant amount of matching federal funds to greatly expand health care access for low-income residents. Texas is expected to receive an estimated 145 billion 81 percent of the national total distributed among the largest entitlement and discretionary federally funded programs.

Appropriated Funds are usually specified in Congresss yearly budget or continuing resolution. How does Texas spending on a per capita basis compare to the rest of the United States.

Tac State Budget Highlights For The 2022 23 Biennium

/cloudfront-us-east-1.images.arcpublishing.com/gray/N75PNUIJPBBVBJ4NAEBOGKDO7Y.jpg)

How Federal Pandemic Aid Helped Texas Pay For Greg Abbott S Border Mission

/static.texastribune.org/media/files/f7586418b7ab68c1f15bc404d67d5952/Operation%20Lone%20Star%20VGC%20TT%2054.jpg)

No comments for "Federal Funds Appropriated in Texas Generally Are"

Post a Comment